When you boil it all down, here’s how you tell the difference between tax bracket and tax rate:

But your budget and spending habits have probably been affected by the same thing that’s affected the 2022 tax rates and brackets-inflation! Yep, this year the income limits for all tax brackets will be adjusted for inflation, so let’s take a closer look at what tax rates and tax brackets are and how they change how much you pay in federal income tax.Īs with most things involving the federal government, the terminology around taxes tends to be more confusing than it needs to be. Tax brackets and tax rates rise and fall depending on the year and current tax law, and if you’re like most people, you probably don’t follow them too closely. And how do you figure that out? That’s right, federal income tax brackets and tax rates. But it’s important to know how much you’ll need to shell out during the year to keep Uncle Sam off your back. (That’s $6,164 less than if a flat 24% rate was applied to the entire $100,000.If there’s one topic we doubt you’re planning to bring up at your next dinner party, it’d be federal income tax. When you add it all up, your total 2022 tax is only $17,836. That leaves only $10,925 of your taxable income (the amount over $89,075) that is taxed at the 24% rate, which comes to an additional $2,622 of tax. After that, the next $47,300 of your income (from $41,776 to $89,075) is taxed at the 22% rate for $10,406 of tax. The next $31,500 of income (the amount from $10,276 to $41,775) is taxed at the 12% rate for an additional $3,780 of tax. Again, assuming you’re single with $100,000 taxable income in 2022, the first $10,275 of your income is taxed at the 10% rate for $1,028 of tax. The rest of it is taxed at the 10%, 12%, and 22% rates. That’s because, using marginal tax rates, only a portion of your income is taxed at the 24% rate.

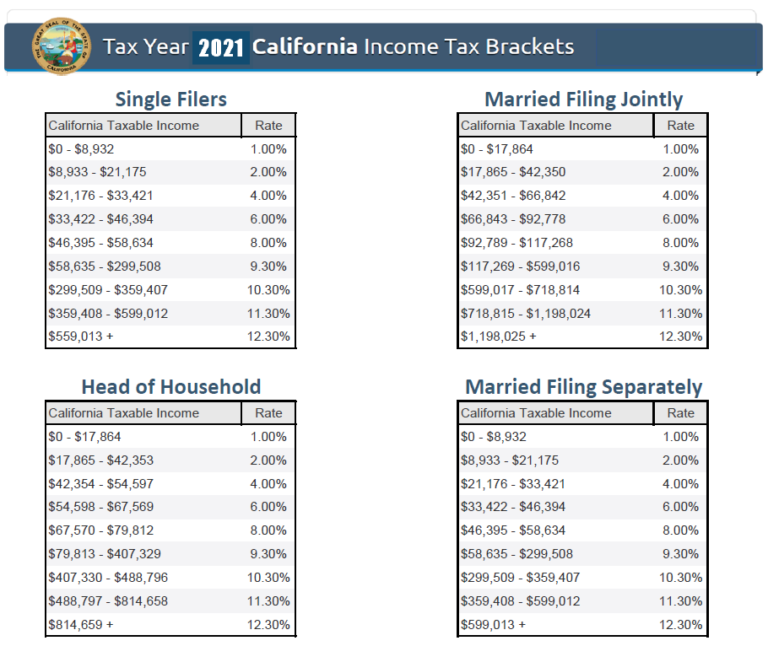

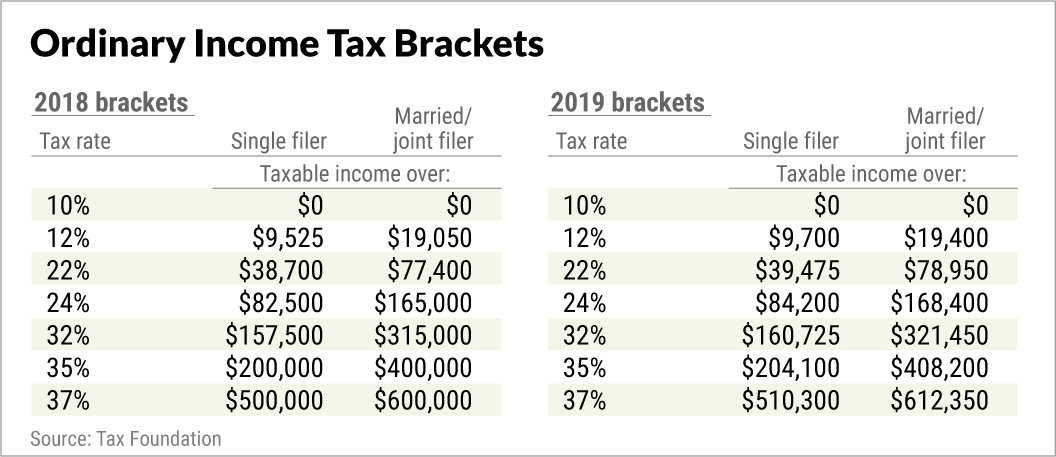

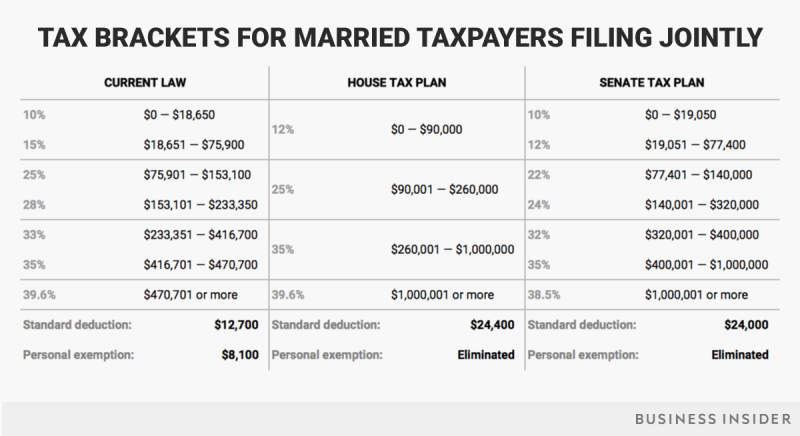

Since $100,000 is in the 24% bracket for singles, will your 2022 tax bill simply a flat 24% of $100,000 – or $24,000? No! Your tax is actually less than that amount. Suppose you’re single and end up with $100,000 of taxable income in 2022. Learn more about how tax brackets work HERE. If you still haven’t filed your 2021 tax return yet, or you just want to compare to see what’s changed, here are the 2021 tax brackets and rates: 2021 Tax Brackets for Single Filers and Married Couples Filing Jointly Tax RateĢ021 Tax Brackets for Married Couples Filing Separately and Head-of-Household Filers Tax Rate 2022 Tax Brackets for Married Couples Filing Separately and Head-of-Household Filers Tax Rate When you’re working on your 2022 federal income tax return next year, here are the tax brackets and rates you’ll need:Ģ022 Tax Brackets for Single Filers and Married Couples Filing Jointly Tax Rate Now, let’s get to the actual tax brackets for 20. (For 2021, the 22% tax bracket for singles went from $40,526 to $86,375, while the same rate applied to head-of-household filers with taxable income from $54,201 to $86,350.) So, that’s something else to keep in mind when you’re filing a return or planning to reduce a future tax bill. However, for head-of-household filers, it goes from $55,901 to $89,050. For example, for single filers, the 22% tax bracket for the 2022 tax year starts at $41,776 and ends at $89,075. The 20 tax bracket ranges also differ depending on your filing status. That means you could wind up in a different tax bracket when you file your 2022 federal income tax return than the bracket you were in before – which also means you could pay a different tax rate on some of your income. However, as they are every year, the 2022 tax brackets were adjusted to account for inflation. The 2022 tax rates themselves are the same as the rates in effect for the 2021 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Unless you requested an extension to file your 2021 return, the next return that most people will have to file is their federal tax return for the 2022 tax year - which, by the way, will be due on Ap(or October 16, 2023, if extended). It’s never too early to start thinking about your next tax return.

0 kommentar(er)

0 kommentar(er)